- Does paypal charge a fee to send an invoice how to#

- Does paypal charge a fee to send an invoice software#

- Does paypal charge a fee to send an invoice plus#

Transfer Money from PayPal Directly to Your Bank Account To access your money fast and avoid PayPal fees, you should do one of two things. How you take your money out of PayPal can be just as important as how you receive it. Change How You Withdraw Your Money From PayPal

You just need to make sure your business can handle the change in cash flow that comes with only getting paid once a month instead of more often. Yes, it’s only $0.49 per transaction, but savings is savings.

Does paypal charge a fee to send an invoice plus#

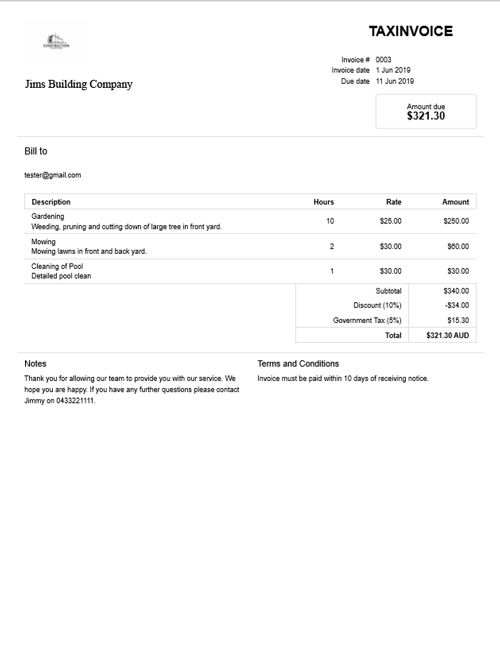

The fee for each transaction is $0.49 USD, plus 3.49% of the amount you receive from U.S.-based clients.įor funds being received from someone outside the U.S., the fee for each transaction is 4.99% plus a fixed fee that varies depending on the country where the funds are coming from.īy opting to be paid only once a month you’ll avoid some of these one-time transaction PayPal fees. This is because PayPal not only charges you a percentage of the money you receive, but they also charge you a fee for every transaction. But, one major downside is paying more PayPal fees. There are a lot of benefits to getting paid more often, such as avoiding cash flow problems in your business. I have some clients who pay me weekly, some that pay me twice a month, and others that only pay me once a month. One way to lower your PayPal fees is to opt to be paid less often. Keep reading to learn 8 ways to decrease or avoid PayPal fees so you can keep more of your hard-earned money: 1.

Does paypal charge a fee to send an invoice how to#

How to Avoid PayPal FeesĪs a freelancer, if you can avoid PayPal fees (or lower them), then you can help your bottom line. PayPal’s 3.49% amounts to $34.90, plus there is the fixed fee of 49 cents. Let’s say you invoice a client for $1,000, and the client opts to pay you through PayPal. Generally, in the United States, companies will pay a commercial fee of 3.49% of the transaction amount plus a fixed fee of 49 cents. When businesses accept payments via PayPal, they get charged a percentage of the sale and a fixed fee. PayPal is convenient, but it is not always free. It used to be if you wanted to accept credit cards, then you needed to open up a merchant account and purchase expensive equipment to swipe credit cards. Thousands of online companies use PayPal as their payment processor. PayPal is “a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders,” according to Wikipedia. Find out how to avoid PayPal fees in this guide.

Or you can skip PayPal altogether and use other payment processors such as Venmo.

Does paypal charge a fee to send an invoice software#

You can reduce PayPal fees by using invoicing software to reduce fees but still get paid via PayPal. Luckily, there are several options available to help us reduce PayPal fees. I hate doing great work for my clients and getting paid, only to see a big chunk of my income going to pay fees. The one thing about freelancing that I absolutely hate (besides self-employment taxes) is paying PayPal fees.

0 kommentar(er)

0 kommentar(er)